FEMA also began to look into modernizing how it calculates the risk of flooding from a methodology it used in the 1970s. Flood insurance is a separate policy homeowners need to take on top of property insurance.įEMA opened up the program to private companies in 2012. Recent changes by the federal government on flood pricing increased the cost of flood insurance for many households.įEMA, until a decade ago, was the only entity that offered flood insurance for homeowners through the National Flood Insurance Program.

FLORIDA FLOOD INSURANCE COST PLUS

Simon paid approximately $3,500 a year for homeowners insurance, plus $2,000 a year for flood insurance.įor her primary residence she had moved out of, she had paid $3,200 a year for homeowners insurance and $1,300 for flood insurance, she added. "But we still had to pay flood insurance," she said. One of the properties Simon used to own in Florida was designed to be elevated and was intentionally designed not to hold water, as it would carry it through a ravine into an aquifer, she explained.

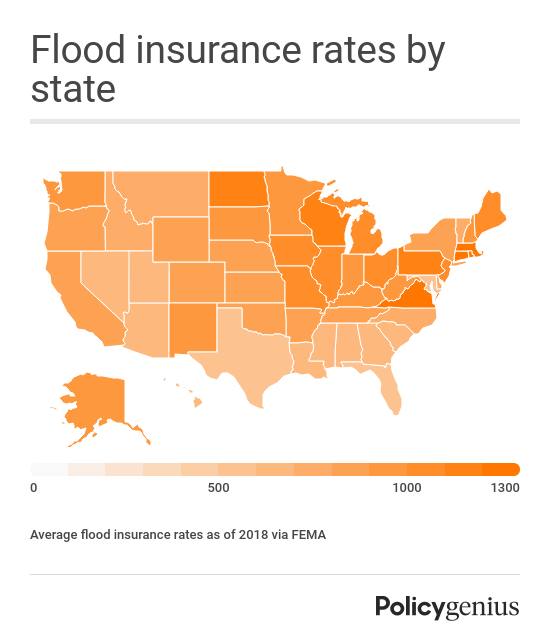

"We had to get flood insurance on one house that will never flood - but it's in the FEMA flood zone," she said. Simon, a Florida native, said she has flood insurance on all the houses that she has owned as a real-estate investor, but the process has not only been expensive, but confusing as well. Nationally, annual premiums are set to increase to $1,808 from $888. For new homeowners, the higher rate could take effect on Day 1. That's based on the new ratings policy introduced on Oct. In Florida, the average annual flood insurance premium is projected to increase by 131% to $2,213 from $958, according to data from the Federal Emergency Management Agency, or FEMA. Many residents of Fort Myers Beach, one of the areas hardest hit by Hurricane Ian, have become homeless while waiting for insurance checks to arrive, or for building permits to be approved so they can rebuild their homes, according to the Associated Press. The average claim for Hurricane Ian was around $5,000, Larsen said, but the range was in reality a lot more varied - some claims were up to potentially millions of dollars. When Hurricane Ian made landfall last September, disaster struck Florida as its Gulf Coast was hammered by the force. The number of homes at risk has grown by 1% from last year, and "is reflective of the preference to live in coastal communities," he added. The estimated 33 million homes at risk is a record, Tom Larsen, senior director for CoreLogic Insurance Solutions, told MarketWatch.

The company said that metro areas like New York City, Houston, Miami and Fort Lauderdale are at highest risk of being affected. That includes over 32 million single-family homes and one million multi-family residences. are at risk of hurricane-force wind damage, according to CoreLogic.

30 - and over 33 million properties in the U.S. Hurricane season has officially begun - it runs from June 1 to Nov. She had previously worked as the Alachua County Schools' Superintendent in North Central Florida. I do not understand why this one hasn't been met with more aggressively," Simon, who is currently an interim dean for the University of Alaska Southeast's School of Education, told MarketWatch. Simon, who owns multiple homes in and around Gainesville, Fla., said that she was paying more in insurance premiums than even the principal and interest on her mortgage. When Carlee Simon, 46, moved to Alaska from Florida for a new job in May, she was in for a pleasant surprise: Her home insurance dropped by thousands of dollars. As hurricane season descends upon the U.S., a record 33 million homes are at risk of wind damage.

0 kommentar(er)

0 kommentar(er)